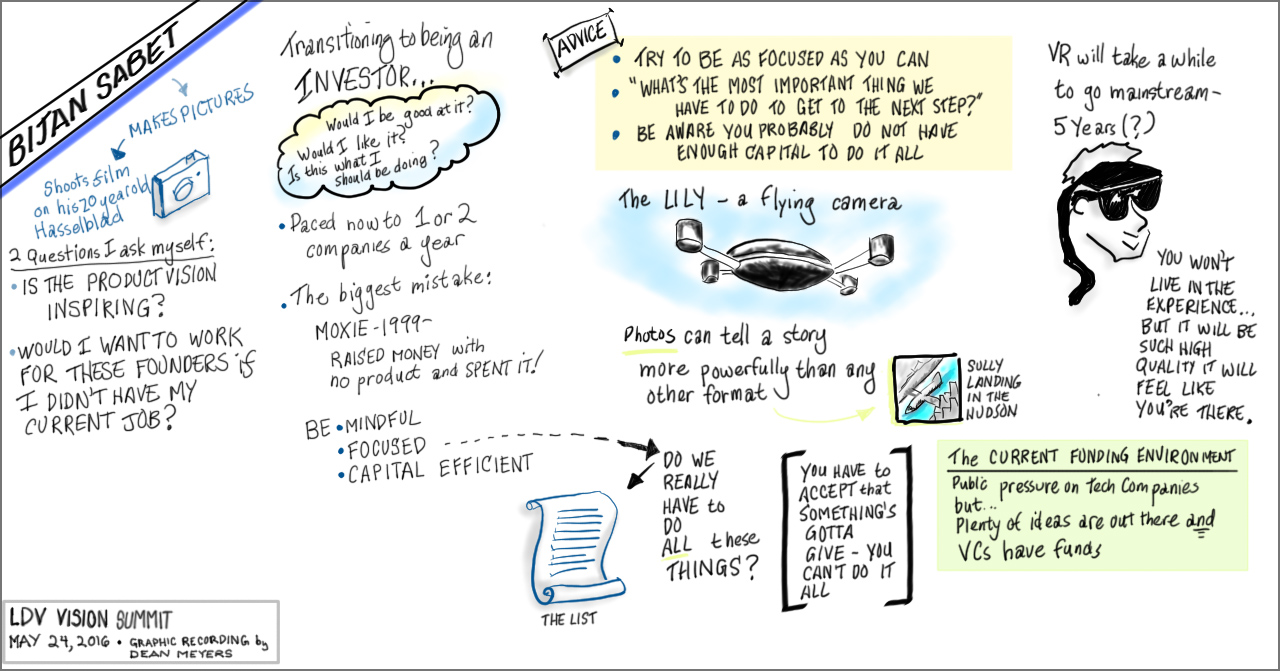

Bijan Sabet Invests in Founders Building Inspiring Products That He Would Want to Work For

/Bijan Sabet, General Partner & Co-Founder, Spark Capital with Evan Nisselson, General Partner, LDV Capital ©Robert Wright/LDV Vision Summit

This Fireside Chat, "Future investment trends and early stage opportunities in businesses leveraging visual technologies" is from our 2016 LDV Vision Summit. Featuring Bijan Sabet, General Partner & Co-Founder, Spark Capital and Evan Nisselson, General Partner, LDV Capital.

Evan: Next up is our next Fireside Investor Chat. I'm honored to bring up Bijan from Spark Capital. We're honored to have Bijan here for multiple reasons. Serial entrepreneur, successful investor, and passionate photographer. We started a pre-interview session a little bit ago, and tell us, the audience, which is a mixture of entrepreneurs, and researchers in computer vision, technology execs, why do you shoot with Hasselblad?

Bijan: It's a funny contrast given what I do for a living.

Evan: Exactly.

@Bijan

Bijan: Hasselblad, they make still cameras, and digital cameras, and medium format cameras, but I shoot a 20-year-old Hasselblad that shoots film, it shoots 120 millimeter film. For me, I discovered film, or rediscovered film, I guess, about three years ago.

Evan: What was that moment where you're like I'm going the other creative direction?

Bijan: I just started reading books about some of the masters, and was amazed at what I saw, and I just wanted to frankly emulate it. Not that I'm coming anywhere close to it, but I just found it really inspiring, and decided to explore film again.

Evan: Are you processing in the darkroom as well, and doing your prints?

Bijan: I don't do that, no. I did that in undergrad.

Evan: That's what I miss. You did do it in undergrad?

Bijan: Yeah, I did do it in undergrad.

Evan: The brown fingers from the fixer, and smelling afterwards.

Bijan: All the chemicals, yeah. No, I found a great lab in Southern California, and I send everything to them. It feels like the right compliment to spending time with digital products all day to have kind of an analog experience. Everything is slow, my Hasselblad takes 12 photos at a time.

Evan: Exactly. I used to shoot with a Rolleiflex, so very similar. Started with a Nikon F, Nikon FM, Rolleiflex, and unlike you I've gone the other direction rather than backwards. In 2003, I got rid of all of them and started with my camera phone, which you'll see in a photo if you're here tomorrow, the Sony P800, in 2003, and I've never gone back. Those twelve pictures, it's interesting, you mentioned you do one or two investments a year...

Skateboard Park, Venice, California. Leica M3, Kodak Portra 400 © Bijan

Bijan: Yeah, so I make more photos than new investments, I guess.

Evan: Actually, probably per fund how many investments would you make?

Bijan: We make about 30 investments per fund.

Evan: No, but you personally?

Bijan: Oh, personally about five or six.

Evan: So there's almost a connection between the number of images in a roll, and...

Bijan: Yeah, I hadn't thought about that.

Evan: That's my role as a moderator.

Bijan: Thank you.

Evan: Do you say take pictures or make pictures?

Bijan: I say make pictures.

Evan: Yeah. Well done.

Bijan: For me, it feels quite good. I don't make fire with two rocks and all that. I still am really excited about what's happening with digital, and connected products, and computer vision, and all sorts of social experiences, but I think if you haven't picked up a film camera in awhile you should do it.

Evan: I agree. We both were operators and went to the investing side. You've been investing a lot longer at a big fund with some great successes. What was the hardest part of that transition? How did you get past any difficulty that might have existed?

Bijan: The hard part on a personal level was I didn't know what I was getting into. Literally 11 years ago I was not an investor, so I didn't know - would I be any good at it? would I like it? What would it be like actually doing this every single day? There were a lot of questions, it was mostly the unknown, and I would say I'm still figuring it out. What the next ten years will look like, compared to the last ten years, it will probably look completely different. I think that's the fun part, but it's been humbling for sure.

Evan: One of my challenges was that as an entrepreneur I always felt that, every single day I could tell whether I was moving the ball forward or backwards. As an investor, it's more of a coach rather than doing, and getting too into the weeds is the wrong thing to do. That for me after 18 years as an entrepreneur was hard. Have you ever experienced that kind of thing?

Bijan: Yeah, for sure. Especially this pace I'm on one or two new investments a year, I'm meeting a lot of companies but only getting involved in a select few. When I first started it was kind of like am I being productive, and I had some mentors that really helped me think about it differently. I'm learning everyday, I'm helping or at least trying to help people, and I guess I am moving the ball forward that way. But in the beginning I felt like, was this really what I was supposed to be doing?

Evan: Sometimes every week I felt like oh, no, don't do that, back up again, no, no, and kept on going back. From the entrepreneur world we have success and failures, and also on the investors' side. What's the biggest mistake you made as an entrepreneur that you learned the most from?

Bijan: I think the late '90s were quite instructive. I was at a company called WebTV in the mid-'90s and that was a great success on many levels: the people, product, outcome was fantastic. The next company was a company called Moxy Digital, that didn't work. We started the company in 1999, we raised $60 million in our series A at 200 pre, with no product, and we spent it, and learned a lot of lessons.

Evan: What was the one big learning lesson? Is there one that actually helps you now on the other side of the table?

Bijan: For sure. I think some of this stuff is fairly well discussed today around MVP and being capital efficient. In those days - it feels like 100 years ago but it's still very painful to some extent - really thinking about being much more mindful and focused and capital efficient are things that I'll never forget from that experience. We were thinking about things completely differently in terms of trying to get big fast, we thought we knew it all and we didn't.

Evan: A couple months ago you wrote a blog post which I loved, Less Things, Better, and it's about setting priorities and focus in business and personal life. It's a challenge I try to figure out all the time. You wrote a list, and then towards the end I think I recall you said you reviewed the list and you said “I think maybe I've got too big of a list, but it’s pretty core stuff.”

©Robert Wright/LDV Vision Summit

Bijan: I think that is the challenge in startups or in personal life - you sit in a board meeting, and you see there all these things to do this year. It's like do we really have to do all these things? Oftentimes, I'm finding as an investor, I'm in a board meeting thinking this stuff is so obvious, and then when I think about our own firm or my own life you realize that this stuff is really hard. This list I made for myself, you're referring to this blog post I wrote, looking back now the list is ridiculous, there's way too many things.

Evan: I read it the first time, I said oh, that makes sense. Then I got to your comment ‘maybe it's a little long,’ I reread it, and it's like yeah, well, it's probably impossible to do all that, but it's the right goals for a year. What were a couple of things, do you remember a couple of those things really quickly just so the audience knows?

Bijan: Yeah, I'm trying to be a better father, better husband, better partner. I think I'm going to lose a couple hundred pounds. I was going to run around the world. It's almost in every dimension I was trying to improve. I think this work life balance we're all trying to juggle, this is still a work in progress with me, but I think it's a bit of a myth. I think you have to kind of pick which ones you really want to excel at.

Evan: You have to sacrifice some of the others.

Bijan: Yeah, something's going to give.

Evan: Right. Looking at this list and the priority question about entrepreneurs, and the ones that succeed are probably focusing on different priorities. When you see a company in your portfolio, how do you address that if they're doing too many things, or how do you coach them in a way so they might prioritize different things?

©Dean Meyers/Vizworld

Bijan: I think the most compelling time is when the company is struggling, you really have to pick and choose. We see some founders do this almost instinctively, and others it's more difficult. It's like if we don't do this, then this is going to be a failure, or why should we do it. One example I went through recently, I've been on the board of a company called Run Keeper for about four or five years. The company was just sold recently, and it was a great outcome for the founders and team and all that, but that company was in a crisis period. It had maybe six months of cash, and had a bunch of products in the market, and was going through a tough time. Nobody wanted to invest in the company, no new investor.

The CEO on his own, he didn't do it in the middle of the night, he came to the board and said this is what I want to do. He cut the burn by a third, he dropped one of the products, just shut it down completely, focused on the core business, had a real chance of getting to profitability in a short period of time, and then he had this great outcome. He sold the company for just under $100 million, he owned the biggest stake in the company, the employees did great, and it wouldn't have happened if he'd kept going down this path of we got to have all these initiatives.

Evan: I think that's great, the outcome is great. Could you filter down that transitional period? In order to help the audience, the entrepreneurs how do you figure out “what should I try to do,” “how should I try to filter” or analyze or rate the things? Do you have any processes that you guys go through with some of your companies or entrepreneurs personally, one on one, like how do we figure this out together?

Bijan: I don't have a secret answer here, but I do think it's trying to be as focused as you can on thinking what's the most important thing we have to get done. Oftentimes we get involved in the company, it's in your earlier stages of the business, and almost by definition that means the capital we're investing is going to be insufficient for the next phase of the company, or for the company to reach its fullest potential. I think at that moment since we're all mindful that we're basically in deficit financing mode, we have to think about it like what is the most important thing we have to accomplish for the company to get to the next stage of the company's mission. I think distilling it down to that, trying to make it a more simpler task is key.

If you could stay capital efficient, and you could find great partners and investors, then you can be singularly focused on what's the most important thing at the time.

-Bijan Sabet

Evan: Relating around the mission a very direct statement of which everything else that doesn't directly tie to that is not dealt with.

Bijan: Yeah. Oftentimes you hear about companies like “hey, there's no business model” initially, and I feel that can be confusing as well because if you start firing up the business model too early it's just another thing you got to worry about, and then you're diluting efforts and everything else. If you could stay capital efficient, and you could find great partners and investors, then you can be singularly focused on what's the most important thing at the time.

Evan: At that point you're talking about capital efficiency. Many in the audience know you and Spark, but for those that don't, could you give a couple sentences about fund size, ideal profile investment, and how early.

Bijan: There's no too early for us. We have offices now in Boston, New York, and San Francisco, and we get involved either at the seed stage or the Series A stage, but we also I would say 20% of what we do now are later stage investing.

Evan: The Seed Stage is roughly how much?

Bijan: Seed Stage is half a million dollars and up.

Evan: And the A?

Bijan: It varies, but it's maybe $4 to $6 million, something like that.

Evan: There's a lot of researchers also in the audience that this is black magic, they have no idea. We're balancing a little bit of the “those that know and those that don't.” Also you've done several deals that relate to visual content, leverage it, it's a byproduct, or it's core to the business, Twitter, OMG Pop, and another one, Lilly Robotics. Tell us what got you excited about that, and what were the kind of behind the scenes questions, was it going to work, is it not going to work.

Bijan: With Lilly, in particular?

Evan: Yeah.

Bijan: With Lilly Robotics, if people don't know, it's a flying camera essentially. Some people look at it as a drone, or something like that. For me, the real excitement was it's a flying camera.

Evan: It's like the polar opposite to the Hasselblad.

Bijan: I guess you're right.

Evan: I love both. I'm just trying to understand.

©Robert Wright/LDV Vision Summit

Bijan: The connective tissue here is that you're making art, or you're making creative media, and our frustration with the other products in the market, it was really tailored towards people that were interested in flying and piloting. If you look at products like DGI, or products like DGI, it's this big honking controller, and there's a serious learning curve because it's a piloting system. We really felt like there's the untapped potential here is what happens when you take a camera and you make it a flying camera, and you're not piloting, you're just creating work. I think that's the opportunity, and that's why I got excited about it.

Evan: The double edged sword there is for the success in the business you cannot wait for all of us to have our hovering cameras waiting for us outside like a limo. The negative obviously is that there's 500 cameras outside waiting and floating in the air for us.

Bijan: Right. I think it's like anything. You go to a concert, and you'll see fans just have their camera phones out, and you can ask “are they enjoying the music or are they just too busy Snapchat’ing the content?” I think it's both, and I think this stuff will find its happy equilibrium.

Evan: What's the one activity that you cannot wait to do, that you cannot wait to be photographed by your Lilly Camera?

Bijan: For me personally it's going to be hiking, but I think we're hearing all sorts of different use cases from people, soccer, swimming, windsurfing, family birthday parties. Somebody recently talked to us about a wedding. I think the use cases are pretty diverse, but it's been very interesting. There's this one recent moment we went to a park in San Francisco after a board meeting, and it's right near a school playground, so there's a fence between the school playground and the public park, and we were out there flying it and all of the school kids see the Lilly guys testing it all the time, so they climbed on the fence and they were like it's the Lilly guys. It was really exciting.

Evan: That's cool. That's great. That kind of ties in across the whole spectrum of this summit. You guys invested in Cruise, and had a great exit with that, Oculus, and also content sites, Tumblr and Twitter, so both spectrums which relate to many of our sessions here. One became the title of our pre-interview, which I loved your statement, was the photographs can tell a powerful story that is unique to any other creative format. One of the things we're going to talk about is 2D, 3D, 360. Why to you is a photograph better than a gif, or better than a video? What are your thoughts there to come up with that conclusion?

Bijan: I just think if you look at history or contemporary times it can tell the story in the most compelling way. In some ways, whether it's that US airplane that landed in the Hudson River, with that Tweet, that photo that went around the world...

Evan: When they were standing on the wings, right, all the people?

Bijan: Right. That person took that photo on a camera phone that by today's standards is fairly low res, but that one picture told that story better than any other news report or anything. You see it today with the Syrian refugee crisis, with that child. These photographs are iconic, and I think we've seen over and over again that this is probably the most powerful format ever, and I think it's going to continue to be that way.

Evan: In relation to that, the great segue is I've still got questions, I've got some evolved ideas the more I've seen recently, 3D content.

Bijan: VR or 3D?

Evan: 3D. Forget about VR. I mean 360 and 3D, without looking at VR for now, do people you think, will people eventually want to see more 3D than 2D?

Bijan: Yeah.

Evan: Let's put 3D roughly like 360, this interactive still, which is not a video, or it's not a gif, but it's this interactive, will five ten years that be the norm and 2D that be like black and white film?

Bijan: There's nothing wrong with black and white film.

Evan: It's a great art, which is all I'm saying. I love black and white, and I still turn some of my colors black and white. It's not a negative thing, but I'm trying to figure out is Instagram, will it be fully immersive pictures, or some other site that's fully immersive, that will be more engaging?

Bijan: It's hard to predict what Facebook's going to do with Instagram. They own Oculus, they own Instagram, so where that's all headed ... I think each of these are going to be its own experience. I think 3D and 360 is a Band Aid to get to VR.

Evan: Why's that?

Bijan: In my view, it's neither fish nor fowl. It's a 'tweener. What we have today with 2D photographs, printed or on screen, that's a durable format for the ages. Gifs are great, I don't think they're going anywhere, but I think 360 is a bit of a hack until VR is fully mainstream, and I think it's going to be mainstream.

Evan: How long do you think it's going to take?

Bijan: It's going to take awhile.

Evan: I know that's the hard question, but I have to ask it or I wouldn't be doing my job. For everybody in the audience, is it five years, is it ten years, is it twenty years?

Bijan: When we invested in Oculus, I think our view was that it was five years out.

Evan: To the masses?

Bijan: Mass market, yeah, for gaming. That was our projection, for gaming. Post acquisition, obviously we have nothing to do with the business anymore, but I think in some ways it's five years out again. You know, this was five years ago, but the significant difference is that Facebook's ambition and audacity for Oculus is much bigger than our ambition, and I was going to say audacity, but maybe naïveté. They're not just in it for gaming, they're in it for everything. I think that's why another five years isn't kicking the can, it's more the aperture got bigger, not to have too many double entendres.

Evan: I like that. That was good.

©Robert Wright/LDV Vision Summit

Bijan: I think that's the reason why it's just probably going to take longer, but I think that the experience is so compelling that I really believe that it's going to happen. It's just too compelling. Versus 3D movies, it's like I don't feel like that's compelling. It's cute.

Evan: I guess the question there is that experiencing that content whether or not it's gaming or other activities, wearing the gear or holding up some cardboard version or evolution, there's going to be a different activity, and it might be 24/7 one day.

Bijan: I hope not. Yeah.

Evan: It might not be, but up until then I wonder whether or not that 3D and 360 images will be everywhere, and become more normal until headsets are prevalent.

Bijan: It might be, but I don't think you're going to live inside the Oculus 24/7, or HDC or whatever competing thing. I think it's going to be when you want that experience you're going to have that experience, and then when you don't want that experience you're going to live your life, and that's okay. I don't think this is an “or”, it's an “and.” I think that's where it's exciting. I mean there's no reason why, in the future, I couldn't do this with you, but I could be in Boston, and it will be as lifelike and realistic as me being here.

Evan: I cannot wait. It'll be fun.

Bijan: Maybe I'm not here right now.

Evan: Nobody will be here right now, we'll be in many different countries.

Bijan: It's possible, yeah. We'll have people from all over the world participating in a way that they cannot do that today, and I think that's exciting.

Evan: I think it is if it becomes immersive enough where we feel like we're there. We purposely do not do live streaming of this event because either you're here or you're not, at least for now.

Another thing I read I'd like to try to understand a little more is how you personally look for companies, and the types of companies you look for. At least on your profile page it says you like to look for companies with new approaches to building communities through the sharing of ideas and interests. Obviously Twitter and Tumblr relates to that, but what do you see going forward with this world of computer vision and others? Are there intrigues that you might have as are you waiting for that to happen, or is it more serendipity when they come through along with the trends?

Bijan: I think what you just described and what I've been excited about is more around shared experiences whether it's in these creative tools like Tumblr, or even in workplaces and teams like what you see with Slack and Trello.

Evan: Trello is one of your deals as well, right?

Bijan: Yeah, we're investors in both. I think that that to me is exciting. There's a lot of energy these days around bots, and things like Alexa and this Google Home thing, and I think they're amazing products from a computer science point of view, or AI/ML point of view, but they don't really do anything for me. I really feel like they're missing the people side of these things. The reason why when I walk into a venue and I see all the FourSquare tips from other people, I find it much more exciting than Alexa telling me to go grab a cappuccino down the street. Her the movie wasn't as exciting as a FourSquare tip. I'd rather have people power the internet versus some machine in Mountain View.

Evan: If AI is working along the learning from the masses, it's basically a collective group of people delivering Her, and so it could be the next generation FourSquare when we come back a couple years, and you say actually I did invest in the next one, which is delivering.

Bijan: The synthesis of the planet.

Evan: Exactly.

Bijan: Remember in Her she was dating a thousand people at the end of that.

Evan: Exactly. That's great. It's insane. We've got plenty more time, and I want to offer up to the audience any questions, and we're going to interact, and so raise your hands if you've got questions. I will keep on firing away. Anybody have one right now? Go ahead.

Audience Question 1: What are your tips for entrepreneurs who are looking to raise capital, especially in the current funding situation?

Bijan: My own take on the current funding environment is at the early stages what you read in the headlines, just ignore it, literally ignore it. I think it's mostly irrelevant. I think the headlines about this volatility, and it's tougher times ahead, it's really for companies with massive valuations and big burn rates. If you're starting a company today, you don't have to worry about either.

I don't think anything's happening in the public markets or macro volatility should discourage anybody from building the next great company.

-Bijan Sabet

Bijan: My own take on the current funding environment is at the early stages what you read in the headlines, just ignore it, literally ignore it. I think it's mostly irrelevant. I think the headlines about this volatility, and it's tougher times ahead, it's really for companies with massive valuations and big burn rates. If you're starting a company today, you don't have to worry about either.

The issue really is, we've got this funk where you have tremendous amount of pressure - public markets are putting pressure on tech companies, and as a result it just kind of goes downwards. At the same time, you have entrepreneurs building extraordinary companies based on amazing ideas, and you have venture capitalists that have never had bigger funds ever, ever, ever. There's no shortage of great ideas getting funded. It's not the case where entrepreneurs are out of ideas, and VCs don't have any money. We're exactly the opposite. We have both of those pieces at work here. I don't think anything's happening in the public markets or macro volatility should discourage anybody from building the next great company.

Audience Question 2: We talked a lot about VR. What's your view on AR? How far do you see that away from being a mass market product?

Bijan: I want to like AR. I really want to like AR. I haven't gotten there yet. I like the concept a lot, but I haven't seen any AR demos, and I've seen a number of them recently in the past, and I don't feel like we're there. I guess the most interesting ones, although it's not exciting, has been like automotive heads-up display systems. I think those are valuable, but by and large I thought even if Google Glass is a real thing, and it was displaying content on the real world, for me that's not, I just haven't found those product demos super compelling. I'm much more in the VR camp than the AR camp. I think the VR one is more intentional, and the experiences are much more interesting.

I want to like AR. I just haven't gotten there yet.

Audience Question 2: Do you think the situation is different for enterprise applications?

Bijan: There might be vertical applications I'm just not thinking about where AR can play a big role, and the experience maybe is more of a functionality than otherwise, but I just haven't seen it. Like for example I've seen some around architecture and things like that, but even that I'd rather have videos or VR. I'm open to other things. Like I said, I want to see it, I just haven't yet.

Evan: The example I'll give you is we invested in a company called Apx Labs[now called UpSkill], which is AR for B2B enterprise, so manufacturing, healthcare, logistics, and it's amazing what they're doing in those spaces on an ROI basis. I think before we get to VR it's actually going to be more AR opportunities, even though VR might be a holy grail until the next holy grail happens of dating thousands of people simultaneously.

Back to this kind of attributes of visual content combined with people sharing, I love this kind of seems like a core passion of yours and belief in value creation. When companies come to you, let's not talk about the ones that you already know, the more challenging for the audience are the entrepreneurs saying wow, “Bijan's smart, I want to meet him at the right time for our business,” which leads to the question, when is that? The second is when is there enough validation in a new relationship of a company that will inspire you?

The product vision or product itself must be inspiring, that's the paramount thing. The other part is, can I imagine if I wasn't doing what I was doing for a living, would I imagine that I would legitimately want to work for these founders. If those two things don't compile, then I tend not to want to invest.

-Bijan Sabet

Bijan: We get involved pre-product as well as post-product, so it's not a particular stage. I really look for personally a few things that I care about, and then the stage is almost less specific.

Evan: What are those?

Bijan: I feel like it is the product - product vision or product itself must be inspiring, that's the paramount thing. The other part is, can I imagine if I wasn't doing what I was doing for a living, would I imagine that I would legitimately want to work for these founders. If those two things don't compile, then I tend not to want to invest.

Evan: That second one, I like the way you said that because you actually would be working for them and vice versa, as a coach as we talked about earlier.

Bijan: Yeah.

Evan: It's basically investing in somebody that you would want to collaborate with, and your example is join them on a team, but you're in effect joining them as an investor.

Bijan: Yeah, and I actually mean, literally joining as an employee, if I wasn't doing what I'm doing. If I was unable to say yes to that question then how am I going to convince their future VP of Marketing that this is where that person should work, and so on and so forth. At the times where I've kind of strayed from that in the last 11 years is the times where I'm like, ah, I wish I had kept that personal criteria going, and the times it's worked out is where that criteria I kind of stayed true to it. It doesn't work for every investor has their own point of view of what makes them excited, but on a personal level that's what I consider.

Evan: Have you noticed traits of those people that work better?

Bijan: Yeah. There's big character differences or people differences between like a David Karp and a Biz Stone, they're very different people, or Palmer Lucky or Michael Pryor of Trello. They're quite different, but they all have a very mission driven sense of why they're doing what they're doing, and I feel like it resonates for me.

David Karp: Leica MP, Leica 50mm Summilux, Kodak Tri-X 400 ©Bijan

Audience Question 3: As a fellow photography enthusiast, more like a personal question to you - connecting startup to photography and such, do you have at a personal level things you believe are missing in the current photography, from technical as in camera point of view to post processing like out of focus issues or low light issues, or how to make a better picture composition? There are a bunch of things which I feel are open there, it's not solved yet. Do you think there's something out there which could be a company out there on any of these, and which one would you bet on?

©Robert Wright/LDV Vision Summit

Bijan: On the device hardware side I feel we have all the capability we need now from an iPhone to a Hasselblad. If you're not making great photos, it's not the camera's fault anymore. It may not even be true 50 years ago, but it's certainly not true today, I think that there's still a lot of headache with sharing, collaborating, storing, backing up. That's still a mess. Whether it's a venture startup opportunity or not, it remains to be seen I guess. In families I find, it's not even my own family, although it's certainly true with our case, sharing, and kind of like oh, you took those pictures on family vacation, I did too, kind of that whole thing seems to be kind of crazy now. We're all uploading to places like Facebook, but they compress the hell out of the photos, they look like shit after a while. I just think that cannot be the answer long term.

There's still I feel like a missing piece on, loosely speaking, I'll call it workflow, backups, sync sharing amongst people that you care about. I don't know where that leads us.

Evan: When you make a picture in any format, how do you choose where to share it?

Bijan: Tumblr's my go-to place for things that I want to publicly share. If not, I'm still old-school. I have a private Flickr account just for our family, my own family, my brother's family, my mom and dad, because my parents aren't on Facebook.

Evan: They're on Twitter ... I mean they're on Flickr.

Old Car, Mission Street, SF: Hasselblad 503cw, Kodak Portra 400 ©Bijan

Bijan: They are on Twitter, yeah, but they're part of the private Flickr group. It seems a little ridiculous that I'm still using Flickr, but that's the one use case.

Evan: It isn't really coming from the spectrum of our conversation, it seems like it makes sense.

Bijan: It does, but given what's happening in the market it feels like I better find a new answer.

Evan: I feel you should stay there.

Bijan: I adore Tumblr. I think it's still my favorite way to share my photos.

Evan: Do you ever put any photos on Twitter? I think I've seen some.

Bijan: I do. I use Twitter for different things, but yeah, I definitely do.

Evan: Is it different type of photographs, or different kind of public events, versus your own photography that you do with your Hasselblad and it's more going to make pictures?

Bijan: I definitely share photos from my Hasselblad on Twitter, but it's something about Hasselblad is this six-by-six, it's this big photo, and then sharing it on a mobile phone, I'd like to think people are seeing it on a bigger screen, but that may just be naive thinking on my part. Twitter for me is just being part of the public conversation. I love Twitter, but it's less about photo sharing than everything else.

Evan: One of the questions that I frequently ask everybody, and I like the composite of all the answers, is very simply, and I asked Howard Morgan earlier, in one word answers your favorite personality trait of an entrepreneur, and your most disliked personality trait, in one word answers.

Bijan: Creative, on the plus. On the negative, for the ones that I have a harder time, indecisive. Indecision with the founders, if I were to pick on one thing. It's hard to beat. We're all human, we're trying to figure this stuff out.

Evan: Mine is passion and selfishness. Obviously some people would say selfishness is a good thing or a bad thing, but I look at it as a horrible thing because it's not team player, it's not building the company, it's all about the individual, which sometimes works sometimes doesn't work for that. The reason I like the one word answers even though they're hard is because they're very easily actionable to people when they hear it. On that note, round of applause for Bijan. Thank you very much.

Bijan: Thank you very much for having me.