Reimagining the Relationship Between Humans & Machines with Neural Interface Technology

/LDV Capital invests in people building businesses powered by visual technologies. We thrive on collaborating with deep tech teams leveraging computer vision, machine learning, and artificial intelligence to analyze visual data. We are the only venture capital firm with this thesis.

In 2019, we had the pleasure of hosting a fireside chat between Thomas Reardon, a computational neuroscientist, co-founder, and CEO of CTRL-labs, and Evan Nisselson, Founder and General Partner at LDV Capital.

Four months later in September 2019, CTRL-Labs was acquired by Facebook for approximately $1 billion, says VentureBeat. He and his team are now integrated into Facebook's AR/VR research group.

Thomas Reardon at LDV Vision Summit in 2019 © Robert Wright

Thomas Reardon wearing a CTRL-Labs prototype on his arm at LDV Vision Summit in 2019 © Robert Wright

Thomas Reardon spent a decade at Microsoft and is known for launching the Internet Explorer browser. He contributed widely to the early architecture, protocols, and standards of the web. Together with Patrick Kaifosh and Tim Machado, two fellow scientists from Columbia University, Thomas launched CTRL-labs to build radically pragmatic non-invasive neural interface technology with single-neuron resolution. To put it in simple terms, they released a wristband to let humans control machines with their minds.

Watch the video below to learn about the rollercoaster of entrepreneurship and neural interfaces.

“Most of you know computational neuroscience as machine learning. Columbia University and University College London have the world’s best computational neuroscience labs. Google’s Deep Mind spun out of the UCL, and our CTRL-labs spun out of Columbia. At heart, we are machine learning folks who are interested in the intersection of machine learning with biology, with real neurons”.

Evan Nisselson of LDV Capital and Thomas Reardon of CTRL-labs are discussing neural interface tech © Robert Wright

“You need high faith and high IQ investors”

Thomas gave great advice for those of you who are starting companies.

“You need high faith investors – ones that will help you raise more money. If you are working on really hard problems you need people who aren’t just looking for tilting up the website in six weeks and getting RPU up within six months. Instead, they are going to think about scientific, technical, and other metrics that will ultimately lead to revenue and profit. They can track them for the next 3-5 years that it might take you to build that thing that can be transformative. That requires high faith investors and high IQ investors.”

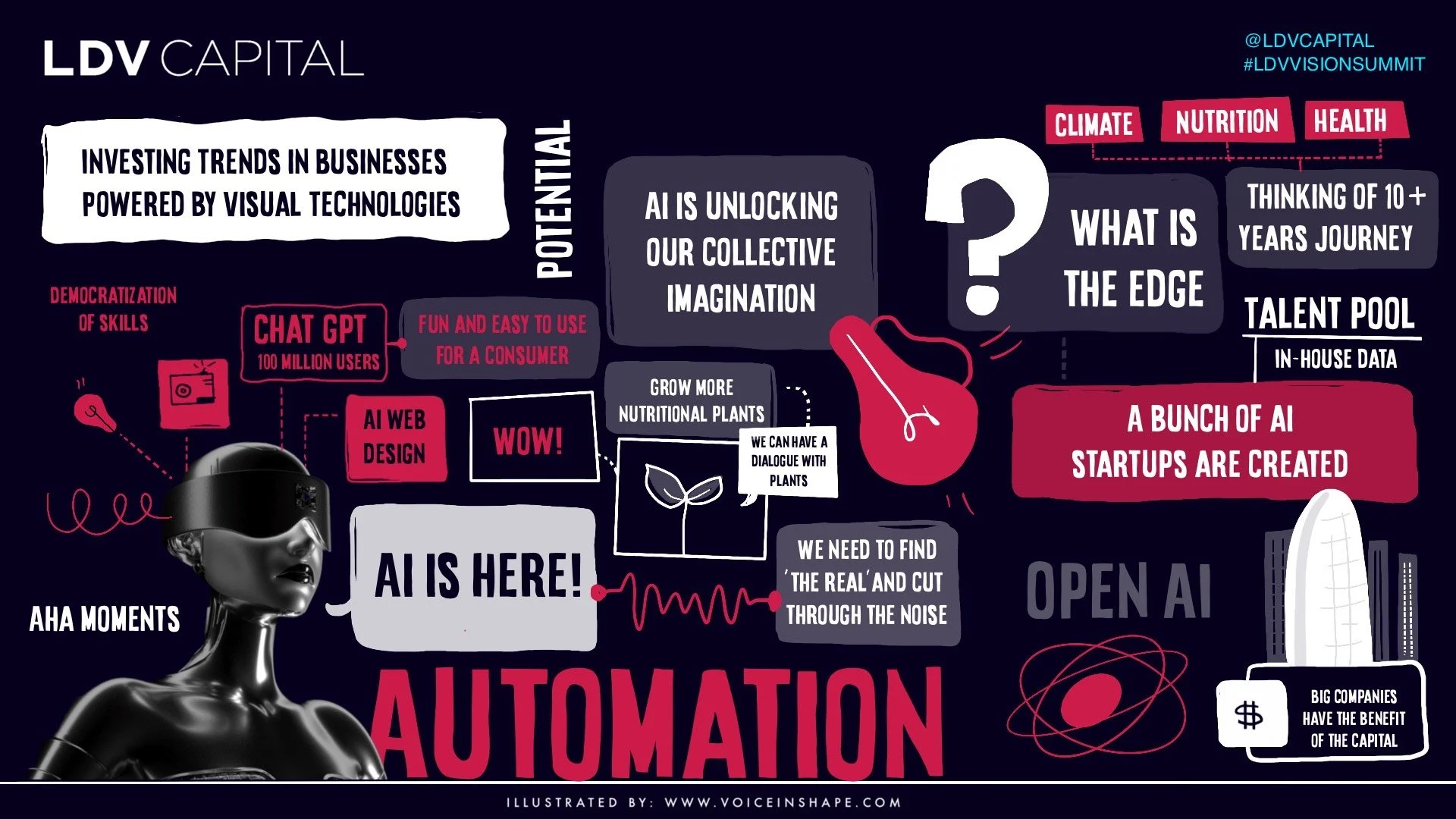

© LDV Vision Summit 2019 & Voice in Shape

A fireside chat with Thomas Reardon Co-Founder & CEO of CTRL-labs at LDV Vision Summit © Robert Wright

LDV Capital regularly hosts Vision events – check out when the next one is scheduled.