3 Years Investing at LDV Capital: Insights from Sourcing, Evaluating & Partnering with Early-Stage Deep Tech Founders

/Ash shared his insights on visual tech, the circular economy & sustainability opportunities at our LDV Capital AGM 2024.

In September 2021, I was fortunate enough to break into the world of venture capital when I joined Evan Nisselson and the LDV Capital team to invest out of Fund III as an Analyst for the 2 year program.

Having been promoted to Associate at the end of the 2 year Analyst program, and now investing out of our fourth fund, I wanted to share insights and reflect on what the past 3 years has been like working on our team, and collaborating with brilliant, deep tech entrepreneurs around the world building businesses powered by visual technology & artificial intelligence.

At LDV Capital, we are the only venture fund with this thesis. We thrive on collaborating with deep tech teams leveraging computer vision, machine learning and AI to analyze visual data.

We are very excited to announce we are recruiting for an Analyst. Join our team to help us identify, analyze and evaluate investment opportunities. You will be a major contributor to all aspects of our fund from sourcing, market research, due diligence and supporting our portfolio companies, and hopefully improving the world we live in.

Here are a few takeaways:

1. Evaluating Early-Stage Companies is Entrepreneurship with a Different Lens

I’ve typically viewed myself as a self-starter, most comfortable in a dynamic, entrepreneurial environment. During my undergraduate studies prior to joining LDV, I co-founded a B2B SaaS startup providing a digital aggregation platform for customer service. When transitioning from a co-founder to a venture capitalist, I knew I wanted to continue being hands-on and having a direct impact, this time with a focus on partnering with exceptional entrepreneurs to improve the world.

From day 1 as an Analyst at LDV, I’ve had the opportunity to do exactly that, diving straight into a dynamic setting working with a tight-knit team. Our team presently has only four full-time team members. We also interact regularly with dozens of LDV experts and thousands more across our LDV Community. I’ve been empowered to lead initial conversations with founders, understand the market they’re operating in, and help reach decisions on whether we should invest.

The process of finding and evaluating early-stage teams is oftentimes more of an art than a science. We invest as early as it gets, leading pre-seed & seed stage rounds. A third of our investments are actually pre-incorporation and all are typically pre-revenue and pre-product. We invest in people first and foremost, as people hire and fire people, make decisions and ultimately determine whether a company will succeed.

Over the last three years, I have met and spoken with several hundreds of entrepreneurs, and reviewed thousands more pitches. The process of filtering which opportunities are likely to stand out has been continuously iterative, and I have relished the opportunity to be able to connect with founders passionate about their unique visions and brainstorm with them on what are the steps necessary to make their visions a reality.

I’ve also majorly benefitted from working directly with our founder & general partner, Evan, who himself was a serial entrepreneur for 18 years building four businesses powered by visual tech, some that succeeded and others that failed. As a result, I’ve been able to hone different skills across analyzing the traits of different founders to thinking about how market ecosystems will evolve to assessing overarching risks.

Like making decisions when building a startup to focus on the right milestones at the right time, deciding when to say ‘yes’ or ‘no’ is an equally invaluable trait as a VC. Since we invest in 4-6 companies per year, saying ‘no’ occurs a high majority of the time. Learning when to say ‘no’ is integral to being able to say ‘yes’ to the right opportunities. Managing my time and priorities in order to focus on opportunities that align more strongly with our portfolio construction has been a critical learning. Being part of a smaller team environment has meant I have been exposed to a high amount of responsibility early on. This has been incredibly rewarding, enabling me to build up the muscle of making efficient and accurate decisions.

Dr. Leo Grady, Founder and CEO of Jona, speaking with Ash at LDV Capital’s Happy Hour event in July 2022.

(L-R) David Concannon, Partner at Goodwin Procter, speaking with Evan Nisselson, Founder and General Partner at LDV Capital, Ash and Rebecca Paoletti, CEO & Co-founder at CakeWorks, at LDV Capital’s Happy Hour event in October 2023.

2. A Unique Thesis is an Opportunity to Stand Out as a Domain Expert

At LDV Capital, we have been investing in people building businesses powered by visual technology & artificial intelligence since 2012. The majority of data our brains analyze is visual so the majority of data that AI will analyze will be visual. Visual data and visual technologies across the light and electromagnetic spectrum are critical for the success of artificial intelligence horizontally across all sectors.

When applying to join the LDV team, I was fascinated by the visual tech thesis and what that entailed. I was aware that future developments in AI would be significant for society, however, my background is not as a deep tech academic or researcher.

Having a technical background is definitely an asset. There is a growing need for leapfrog advancements to provide significant differentiation and defensibility within the visual tech ecosystem. A strong understanding and knowledge to assess the technical viability and potential of new opportunities is a plus for a new team member.

Nevertheless, despite the lack of technical background, the unique thesis we invest with has allowed the opportunity to set myself apart as a domain expert. When I first started, I immersed myself in as much technical documentation as possible, such as our LDV Capital Insights Reports dating back to 2017. Additionally, a third of our LPs are what we call the ‘imaging mafia’ who are experts in visual tech and many have founded and sold visual tech powered businesses. Our expert network consists of an extensive inner circle of computer vision and artificial intelligence experts, serial entrepreneurs, technical advisors, growth hackers, marketers and more.

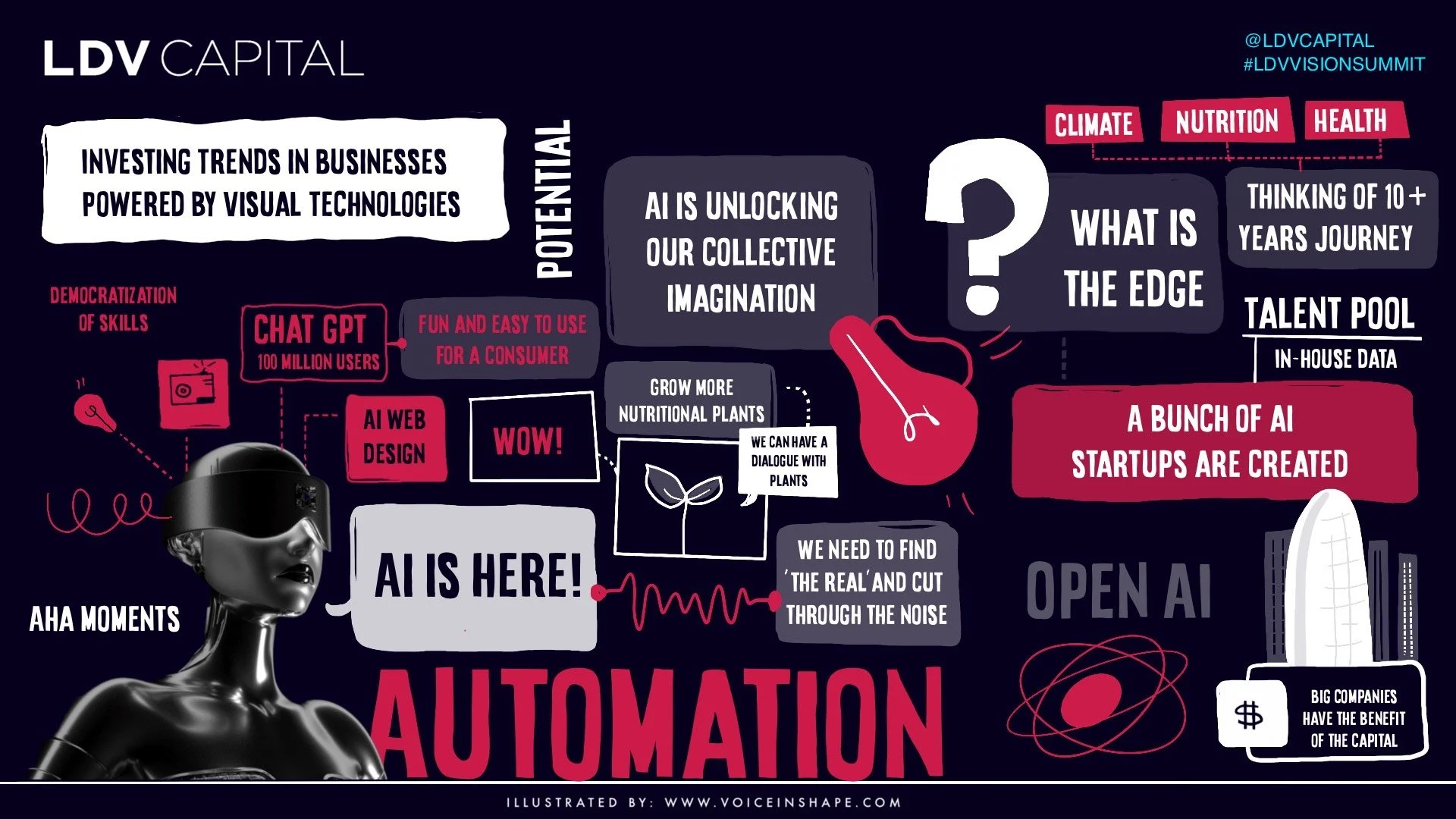

Over the past three years, I’ve had the chance to learn alongside all of these domain experts, absorbing conversations at our Annual General Meetings, Annual Vision Summits, community happy hours and regular 1:1 meetings in the city. I am constantly learning and this continues to inspire me. These conversations improve my technical skills and research ability to dive deeper into sectors and trends we’re excited about, influencing my sourcing angles and having a significant impact on investment decision-making.

In particular, I’ve researched and published articles on how visual tech will shape the future of materials science, the circular economy, life sciences & biotech & more. You can tune into the Materials Science panel with esteemed domain experts which I will be moderating at our upcoming 11th Annual Vision Summit on March 25th.

Ash (center) at our Annual General Meeting in 2024.

3. Setting Expectations for a Long Term Rollercoaster

When we invest, we are looking to partner with early-stage teams over many years with the goal of improving the world we live in and making money while we sleep to provide outsized returns to our investors. We aim to empower founders without getting in the way and partner with them to hopefully focus on the right milestones at the right time. Over 90% of our portfolio companies have gone on to raise follow-on financing from top tier funds after our initial LDV investment in a company. My personal goal is to continue empowering the brilliant deep technical teams we partner with to demonstrate product-market fit, exponentially scale and build valuable businesses.

As an early-stage investor, the timeline for validating successful outcomes takes many years, and so setting ambitious yet realistic expectations are necessary. I have been fortunate enough to experience many wins during the past 3 years. These include: sourcing multiple investments myself, helping lead due diligence on several more investments (including a portfolio company that exited for a positive return last year) and significantly building and growing my community and network. I get to work with a fantastic team every day, and I am inspired by the transformative technological developments that are occurring above and below the surface.

On the other hand, I have experienced plenty of losses. The first sourced investment opportunity I made that progressed to the term sheet stage unfortunately didn’t go through. Other opportunities where I’ve been excited to speak with the founders have failed to convert into a conversation, or the timing has been slightly too late for our LDV stage after a team has already raised significant capital. During each of these points of time I’ve reminded myself to adjust for the longer term rollercoaster and the ups and downs along the way. If anything, this has helped strengthen my resolve and made me more motivated to find ways for our portfolio to succeed.

Three years at LDV Capital only marks the beginning of my journey in venture capital. Going forward, I’m excited to continue learning first-hand how to source companies more effectively, provide value-add support to our existing portfolio companies (a topic I will cover some day in the future), continue finding more exceptional entrepreneurs to partner with, and build valuable and successful venture funds.

We are looking for brilliant people to join our team - check out available LDV jobs here.