AI in Insurance: Partnering with ResiQuant to Turn Catastrophe Risk into Resilience with AI-Powered Property Intelligence Platform

/The $200B US property insurance market is currently facing a pivotal stress test as economic losses from catastrophic disasters soar. The prevalence and effects of natural disasters across the US has heightened, as seen by the damages caused by hurricanes Helene & Milton, and the recent wildfires in California. These catastrophes highlight the extreme urgency of understanding structural vulnerabilities to maintain coverage in disaster-prone regions.

Carriers are consequently seeking to overcome unprecedented challenges: reinsurance costs up 50% since 2020, $217B in natural disaster losses in 2024, and increasing difficulty maintaining coverage in major markets as outdated manual workflows are unable to keep up. Traditional data fails to capture building-specific vulnerabilities, and without innovation, communities lose coverage, carriers face rising losses, and no incentives exist to reward resilient building practices.

ResiQuant is an AI platform transforming how property carriers operate and scale in regions exposed to climate and seismic risks. ResiQuant’s platform combines structural engineering expertise with AI to identify critical building vulnerabilities and attributes that determine survival during disasters – from earthquakes to climate-driven catastrophes like wildfires and severe storms.

Co-founders Dr. Omar Issa and Dr. Francisco Galvis at Pear VC accelerator in 2024. The company was covered on TechCrunch: “Our favorite startups from Pear VC’s invitational demo day” ©Pear VC

Co-founders Dr. Omar Issa and Dr. Francisco Galvis built ResiQuant from direct experience with catastrophic risk assessment. Dr. Issa, a second-generation structural engineer specializing in disaster response, and Dr. Galvis, an expert in building resilience who conducted post-disaster inspections following the Turkey Earthquake and Hurricane Ian, met at Stanford University's Blume Research Center in 2020 while they were pursuing their PhDs.

L-R: Lei Cao, Founding Lead AI Engineer, Dr. Francisco Galvis, Co-founder & CTO, Dr. Omar Issa, Co-founder & CEO, Alex Avtanski, Founding Engineer, Stefanie Rae Arizabal, Senior Structural Engineer & Ishan Chowdhury, Disaster Data Engineer ©ResiQuant

ResiQuant's founders combine deep structural engineering expertise with a shared mission to transform property risk assessment: Omar, CEO, combines hands-on disaster response experience with pioneering AI research. During his career, he has been deployed for post-disaster inspections and reconnaissance, giving him a firsthand understanding of why buildings fail. His PhD research at Stanford focused on using novel AI frameworks to recommend adaptation strategies that prevent losses and downtime before disasters strike. Francisco, CTO, specializes in structural behavior and designing solutions that integrate automation with engineering principles. His experience spans from hands-on building design to pioneering research in disaster risk. He has co-authored multiple papers in top journals on experimental and computational approaches to building resilience, bringing both academic rigor and practical engineering expertise to ResiQuant's technology.

ResiQuant emerged from a personal mission to help communities become more resilient to disasters. Through hundreds of conversations with underwriters and catastrophe modelers, they identified a critical industry challenge. Together, they have a clear vision: transform how carriers evaluate disaster risk by combining structural engineering precision with AI automation. Today, their platform enables carriers to maintain profitable coverage in markets others have abandoned, while creating powerful financial incentives for resilient building practices. It's not just about keeping communities insured – it's about building a future where every property owner has both the coverage they need and clear rewards for investing in resilience.

"Property carriers make billion-dollar exposure and capital allocation decisions with dangerously incomplete data," says Dr. Issa, ResiQuant's CEO. "We're transforming this paradigm by delivering engineering-grade analysis that reveals hidden structural vulnerabilities in every building – helping them underwrite with confidence and maintain coverage precisely where others are forced to retreat."

ResiQuant's platform combines structural engineering expertise with visual tech & AI to analyze site inspection photos, aerial views, and publicly available visuals. Their AI agents process submissions while providing engineering-grade vulnerability analysis, catching critical risks traditional data misses. Additionally, the platform generates portfolio-wide insights that strengthen reinsurance negotiations and enable confident growth in challenging markets.

Visual demonstration of ResiQuant’s AI agent performing engineering analysis.

Golden Bear Insurance Company, a leading provider of commercial property & earthquake, primary & excess casualty, and professional liability in 37 states, has adopted ResiQuant’s platform to improve risk selection, automate underwriting workflows, and support stronger reinsurance negotiations. ResiQuant operates on an agent-based subscription model where carriers deploy AI agents tailored to their needs. Their pricing scales with carrier volume while maintaining strong ROI through operational efficiency gains, improved risk selection, and favorable reinsurance outcomes.

"ResiQuant is transforming how we process submissions, delivering risk-specific engineering insights at remarkable speed,” said Michael Brown, VP of Property at Golden Bear Insurance Company. “This is helping our underwriters better understand each risk, set pricing based on robust and specific risk data, and write CAT exposed business with greater confidence based on better information."

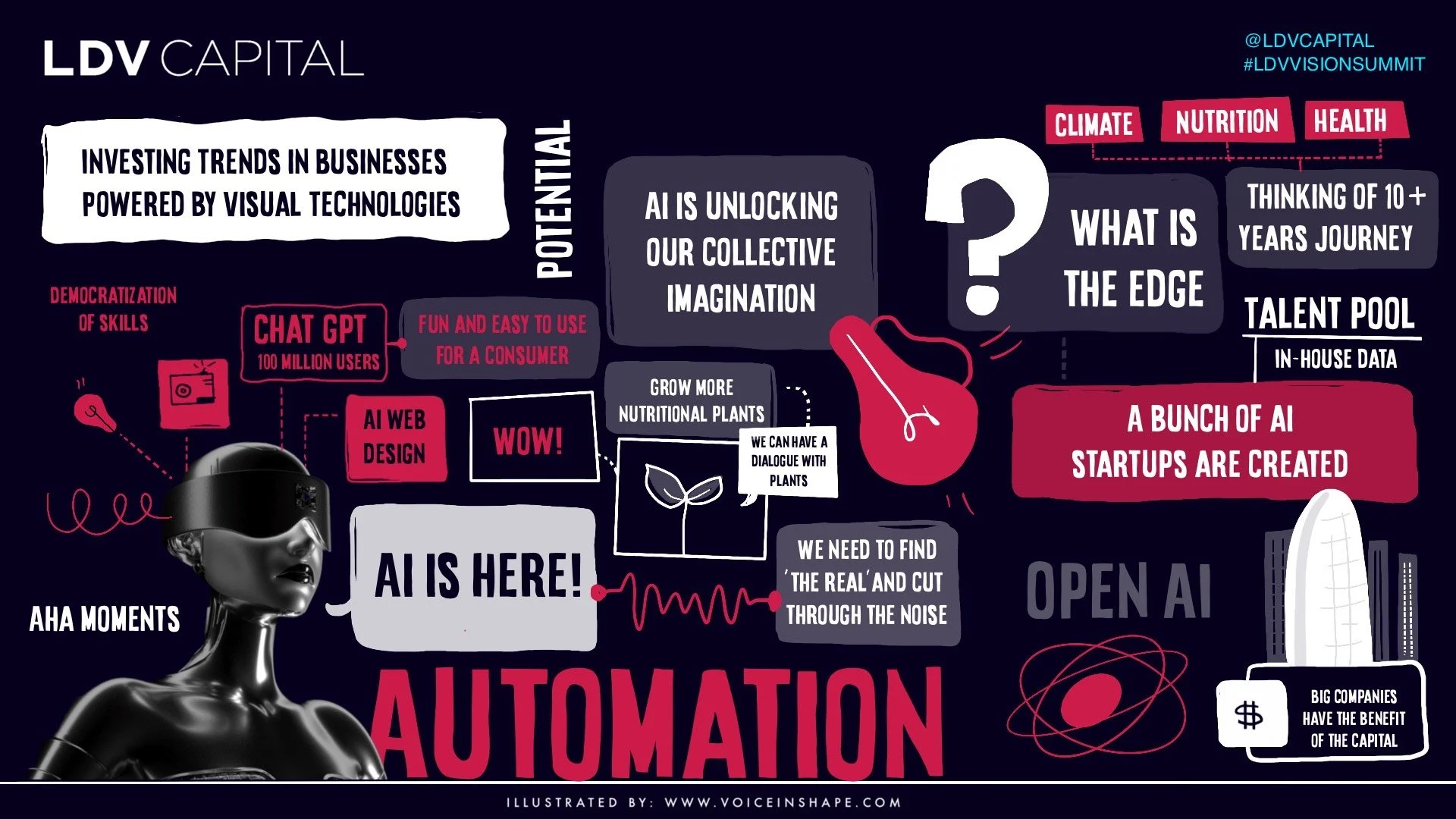

At LDV Capital, we invest in people building businesses powered by visual technology & artificial intelligence. We thrive on collaborating with deep tech teams leveraging computer vision, machine learning, and artificial intelligence to analyze visual data. We are the only venture capital firm with this thesis since 2012.

We are very excited to partner with the fantastic deep tech team at ResiQuant that is developing a platform that utilizes agentic AI and computer vision to transform data into actionable, building-level insights. This empowers property owners and carriers to mitigate vulnerabilities, streamline workflows and enhance underwriting decisions. The insurance industry is on the brink of significant modernization and digital transformation, much like what we've seen in the finance and construction sectors in recent years.

Visual demonstration of ResiQuant’s property-specific analysis.

We at LDV Capital led their $4M seed round with participation from Foothill Ventures, Pear VC, Alumni Ventures and angels. The new funding will be used to extend the capabilities of ResiQuant's platform and grow their engineering and AI units to support carriers across all major US property markets. Read more in Mia Macgregor’s article in The Insurer / Reuters.

ResiQuant is the only platform that seamlessly combines building-level vulnerability analysis with streamlined underwriting operations. At its core, ResiQuant enables carriers to make smarter, faster, and more profitable decisions while driving resilience in the built environment.

Looking to the future, ResiQuant is building the foundation for a more resilient insurance ecosystem. Beyond their current focus on earthquake and wildfire risk, the team will expand to cover all major natural hazards affecting US properties, help carriers reward and incentivize resilient building practices & enable communities to maintain insurance coverage despite growing climate risks.

We look forward to helping ResiQuant leverage our visual tech domain expertise, decades of experience building businesses and our network across property insurance.

This article was written in collaboration with Ash Cleary, an associate at LDV Capital.